By Bill Oppenheim

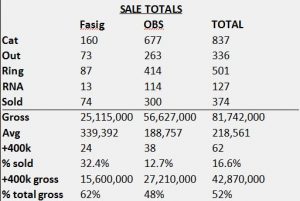

At the two major 2-year-old in training sales held this month in Florida–Fasig-Tipton in Miami Mar. 1 and OBS in Ocala last week–a total of 62 2-year-olds (24 at Fasig, 38 at OBS) were listed as sold for $400,000 or more. Obviously the only way a consignor can lose money selling a $400,000 2-year-old is if they paid way too much for it as a yearling, so for the purpose of this discussion we're going to refer to those 62 2-year-olds as 'home-run' sales horses.

This is what all consignors are trying to do–sell a home-run horse who hopefully will go on to justify its purchase price but, most importantly, is a commercial home run. We hear an awful lot about how the market is 'polarized' between the few 'haves' which everybody wants and the overwhelming majority of 'have nots'–2-year-olds which are not home-run horses.

But what does this polarity really mean in financial terms? We all have the sense that pinhookers and consignors need at least one 'home run' for the numbers to pencil out, but can we quantify the risk/reward ratio? Of course we can, otherwise we wouldn't bring it up! With the assistance of my associate, statistical whiz Dr. Emily Plant, Associate Professor in the Business School at the U. of Montana, we have looked at the pair of sales from two standpoints: what percentage of 2-year-olds in the sales are home-run horses, and what can we estimate is the overall profit or loss of pinhookers in the two sales?

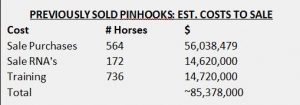

There were 837 2-year-olds catalogued to the two sales; of those, 736, or 85%, went through at least one previous sale and were listed as either sold (564) or RNA'd (172).

We cannot establish a sale price for the RNA's, but the 564 which were previous listed sales had cost their buyers a total of $56,038,479, for an average of $99,359–we can round that up to $100,000. A study we did some years ago told us horses bought back were then sold for an average of 85% of their hammer prices. If we make the global assumption they, too, were $100,000 horses, 85% of $100,000 x 172 works out to $14,620,000–our other assumption being, if they were catalogued for sale, the idea was to sell them. Then, if we project $20,000 per horse to train them from purchase to attempted re-sale, 736 x $20,000 equals another $14,720,000. Conclusion: we're projecting the total cost of getting the 736 2-year-olds to the sale comes out to about $85.3-million. Now that is for the 736 which had been through a sale; we're not making any estimates about the 101 2-year-olds catalogued which had not been through the ring.

Of the 837 horses which were catalogued, 374 were listed as sales by the end of the sale days (OBS will have added to this through private sales which were added later, but it doesn't materially alter the analysis), and 463 were not listed as sales, of which 336 were withdrawn and 127 were RNA'd at Gulfstream or OBS.

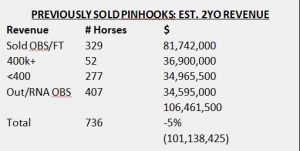

Of the 374 listed sales at Gulfstream and Ocala, 329 had been through a ring before, including 52 of the 62 'home-run horses' (84%) which sold for $400,000 or more. Since we are not trying to establish a cost basis for the 15% of catalogued 2-year-olds which had not previously been through the ring, one calculation we can make is the percentage of 2-year-olds which became home-run horses. We don't calculate this using the 329 listed 2-year-old sales which had gone through the ring, rather we must use the 736 (of 837 catalogued) which their consignors must have intended to sell, and which had been through a ring previously. Fifty-two divided by 736 works out to 7.06%; so the odds of selling a home-run 2-year-old (defined as listed as being sold for $400k+) were approximately 13-1. Let's see how that compares to a couple of other key percentages/ranges:

We can also take a stab at calculating the total revenue generated by the 736 2-year-olds which had previously been through a sale. Recall above we estimated a cost of $85.3 million to buy and train these 736 horses. So 329 of those were listed as sales at Gulfstream or OBS, 407 were not. The 52 home-run 2-year-olds (which had previously been through a ring) grossed $36,900,000–an average of $709,615! Wow; great business if you can get it: 16% of the horses sold generated 51% of the revenues. The other 277 2-year-olds listed as sold (which had previously been through a ring) grossed $34,965,500–an average of $126,232, in other words pretty much a break-even proposition if their average cost was $100,000 and it cost $20,000 to train them. But what of the other 407 2-year-olds (which had previously been through a ring), which did not sell, were either withdrawn or RNA'd? Let's be incredibly generous and say they averaged 85% of their original prices, which at $85,000 per horse for 407 horses would work out to $34,595,000.

Then we add $36,900,000 (52 home-run horses) plus $34,965,500 (277 not home-run 2-year-olds) plus $34,595,000 (407 2-year-olds catalogued but not sold); total–$106,461,500. If we deduct 5% commission for the sales company and no deduction for the consignor the net revenues would be $101,138,425–a gain of 18%. If you are an investor and the consignor also earns a well-deserved 5% agent's fee, the net revenues would total $95,806,350–a gain of 12%.

So this is our conclusion about the results of the two sales:

Not a subscriber? Click here to sign up for the daily PDF or alerts.