By Dan Ross

A deal that Del Mar has made with a titan of Computer Assisted Wagering (CAW) provides a rare glimpse into the tremendous sway that individual players can wield over track and racing officials, the potentially lopsided economic ramifications of such deals, and the tremendous pressures that California executives are under with competing jurisdictions that enjoy purse subsidies not available in the Golden State.

It also turns a spotlight onto a world largely hidden from the public eye-one that industry leaders are generally loathe to discuss publicly, and in which just a few anonymous gamblers can have an outsized impact on the financial fitness or ill-health of the sport.

Last year, Del Mar continued a deal with a player identified as Elite 17 that saw them enjoy a noticeably more favorable rate of play than other high-volume players that wager through the CAW platform, Elite Turf Club, according to detailed wagering reports obtained by the TDN, background conversations with racing officials and figures within the CAW world, along with publicly available data.

At the enormous volumes CAW gamblers play, such deals can give individual players a significant financial edge.

The result was that this one player constituted nearly 47% of Elite Turf Club's total handle on Del Mar last year, according to the reports. Two years prior, Elite 17's play had constituted just over 36% of Elite Turf Club's total handle on Del Mar, according to publicly available California Horse Racing Board (CHRB) data.

At the same time, the amount of money another Elite Turf Club player (Elite 2) wagered on the track dropped off by over $32 million between 2021 and 2023, the reports show-from around $45 million in 2021 to around $13 million last year. In 2021, Elite 2's play came to just over 27% of Elite Turf Club's total handle on Del Mar. Last year, that number had dropped to around 12%.

According to multiple sources familiar with the situation, Elite 2 received a deal similar to Elite 17 in prior years at Del Mar, but not last year.

An individual familiar with the situation-who spoke as a “California racing source” on condition of anonymity-said that, prior to the track's 2023 summer meet, Elite 2 declined such a deal, which would have necessitated paying a “substantial seven-figure up-front payment.”

When asked if Elite 2 had changed their mind about the deal after the summer meet was underway, the source declined to answer, citing concerns about proprietary business information. “But you can't make an up-front payment after the meet has started,” the source added.

Such arrangements have served as a pre-payment on host fees to be split between the track and the purse account, sources say.

The deals that Del Mar has struck with Elite Turf Club players over the years, while hardly an anomaly among tracks nationally, nonetheless raises questions about the best approach to managing CAW play in a state where purse revenues are generated solely through betting. If purses fuel the sport, getting this equation right is an imperative.

Are deals between tracks and individual CAW players, therefore, a sustainable approach for growing the sport in California? Is CAW play now so vital to the economics of horse racing that every step must be taken to maximize their business? Or should California's tracks be much more focused on incentivizing play from the average punters who generally contribute the biggest slice to purses, rather than pandering to the whales of the betting seas?

While it's difficult to know exactly how such deals might have impacted Del Mar's purse account revenues, the bare numbers illustrate a track facing tough economic headwinds, with serious implications for the horsemen and women in the state.

Purses last fall at Del Mar were reduced by over 10% due to a purse account overpayment reportedly to the tune of $2.1 million. All-source handle at the track's flagship summer meet declined nearly 11% from 2022 to 2023, according to the DRF. Wagering through Elite Turf Club on the track's product has declined from around $167 million in 2021 to around $113 million last year, according to the CHRB.

“As a track with no subsidies from alternative forms of gaming that depends exclusively on handle for purse generation, promoting handle from all segments of the betting market is very important to us. On an annual basis we sit down with the [Thoroughbred Owners of California] TOC to both establish purse levels and to discuss how we best promote wagering on our simulcast signal,” wrote Del Mar Thoroughbred Club president, Josh Rubinstein, in response to a series of questions.

Before the start of each meet in California, the tracks present the TOC with a list of individual host fees charged to each location that receives its simulcast signal. For that track's meet to proceed, the TOC must first sign this document.

“We are proud of our racing product, which has been well-received for the last several years, and confident that our host fees are fair and competitive with other major race tracks. We will continue to work with our partners to balance pricing considerations with the overall demands of the wagering markets,” Rubinstein added.

BACKGROUND ON RATES AND REBATES

The debate around CAW players typically surrounds the major edge they wield over regular gamblers thanks to their use of sophisticated wagering technologies and the attractive rates and rebates offered to them-inducements not available to the average punter.

When “rates” are mentioned, what is meant are “host fees.” This is a charge wagering outlets pay to track operators for the contractual right to import a simulcast signal. A wagering outlet could be another racetrack, an ADW platform (like FanDuel), or a CAW platform (like Elite Turf Club).

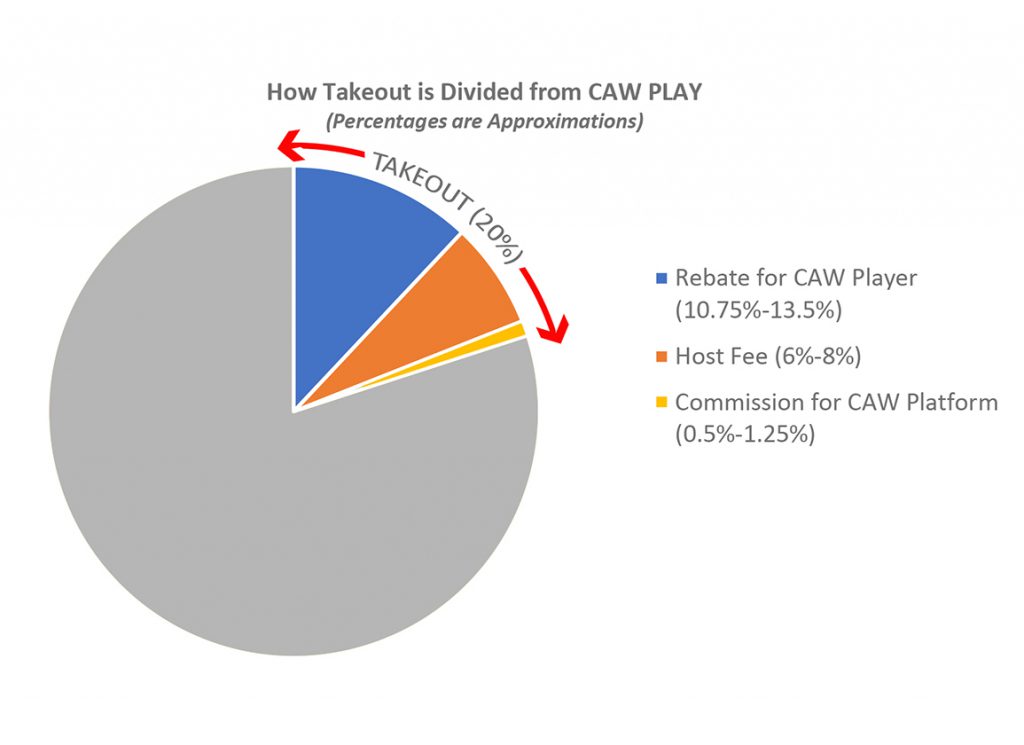

Experts say that CAW host fees for the premium tracks typically vary between 6% and 8%. After breeders' premiums and other minor deductions have been removed, host fees are roughly split 50/50 between the track and the purse account in California.

The entities that pay the lowest host fee, therefore-like CAW players-contribute the lowest per-dollar amount to purses. At the same time, proponents of CAW argue how these inducements are warranted due to the vast amounts these players inject into the betting pools.

The amount CAW players are “rebated” can be broadly calculated with this simple equation:

Rebate = Takeout minus host fee (plus any other associated minor fees). The smaller the host fee and the larger the takeout, then the bigger the rebate.

Let's use the 20% blended takeout rate among the pools. And let's say the host fee (plus other associated fees) that the CAW player pays comes to 7%.

The rebated discount for the CAW players, therefore, could be a maximum 13% on every dollar wagered.

Experts recently told the TDN that the most successful CAW players can consistently win at an average rate of around 92%. At that win rate, a 13% rebate (for example) would see the player enjoy a 5% profit margin.

According to wagering reports reviewed by the TDN, that win rate is an undercount. These reports show how Elite Turf Club players can win at an average rate in excess of 105%, even before their rebate from Elite is factored in. At this rate, the profit margin would be much better than many investment accounts.

It's also important to note how the numerical monikers given to Elite Turf Club players-a company majority owned by The Stronach Group (TSG)-don't relate to just one person.

These players employ a team of potentially dozens of people, including mathematical wizards who create sophisticated computer algorithms capable of analyzing the betting markets for exploitable weaknesses, as well as individuals who place the bets for them.

Insiders consulted for this story describe how these teams of experts can, over time, deduce through the betting markets and through other data sources if rival CAW players receive more favorable rates.

Given the money at stake, the competition can be cutthroat.

ELITE 17'S DEAL

As CAW play has grown exponentially in recent years, track operators have cut deals like that between Del Mar and Elite 17 to attract their business. And the amount these gamblers wager is often so huge, just one player can make up a significant portion of a track's overall handle.

In 2019, when the renowned gambler “Dr. Nick” stopped wagering on Australian racing reportedly due to increased taxes on bookmakers, his exit was projected to trigger a 6% drop in turnover on racing across the board.

Multiple sources for this story said that Elite 17 and Elite 2 were both well-known Australian gamblers.

Scott Daruty, president of both TSG's Monarch Content Management and of the Elite Turf Club, declined to confirm or deny their identities, citing confidentiality agreements.

According to detailed reports obtained by the TDN, Elite 17 wagered more than $650 million on U.S. racing through Elite Turf Club alone last year. In 2021, Elite 17 wagered roughly $60 million on Del Mar's product, according to the CHRB. Last year, Elite 17 wagered some $53 million. Last summer at Del Mar, the amount Elite 17 wagered was roughly 10% of the total handle at Del Mar, using the DRF's all-source handle figures as a baseline.

These numbers don't account for Elite 17's potential play on horse racing through other methods such as fixed-odds providers and exchange options like Betfair in other countries, or on other sports. Some CAW players also have accounts with different CAW platforms like Velocity, owned by Churchill Downs, which enables wagering on tracks whose simulcast signals are managed by Churchill.

At the same time, multiple sources say individual deals are still fairly prevalent among smaller tracks struggling financially, but that they're now unusual among the nation's top-tier tracks.

According to wagering reports reviewed by the TDN, the New York Racing Association (NYRA) offered the same host fee to Elite Turf Club players at Saratoga last year, irrespective of the betting pool. This included Elite 17. The host fee NYRA charged was slightly lower than Del Mar charged the same CAW players (outside of Elite 17), these reports show.

“NYRA cannot responsibly comment or opine on information never provided to our organization,” wrote NYRA spokesperson, Pat McKenna, in response to questions about the wagering reports. The TDN provided to NYRA an overview of the figures in the reports but not the raw data. NYRA's data was independently verified for the TDN. NYRA is a minority owner in Elite Turf Club.

McKenna did, however, stress the steps the organization has taken to manage CAW play, including barring CAW play in the Pick 6, Late Pick 5, and Cross Country Pick 5 pools, and requiring CAW players to place win bets on its races no later than two minutes to post.

California has also taken similar steps to moderate CAW play.

Since Santa Anita's 2022 fall meet, the win pool has been closed to CAW players one-minute to post, or else they must also pay a surcharge of around 3.5% on top of their normal rate if they want to bet to the close of the win-pool. Last year, Del Mar followed suit. Both tracks have also reverted to the traditional Pick 6.

When it comes to Del Mar's deal with Elite 17, the agreement was incumbent upon the player making a substantial payment at the start of the meet, according to multiple sources. Once that up-front payment was made, Elite 17 paid a host fee almost half of that for other Elite Turf Club players, wagering reports show.

But multiple sources familiar with the situation explained how factoring in the up-front payment, Elite 17 paid a host fee on Del Mar's product last year around a percentage point or so lower than the other CAW players.

At the volume CAW gamblers play, just one percentage point difference in host fee can mean a significant edge for one CAW player over all others, along with possible residual effects on all other participants in the betting pools in terms of late odds movement.

TOC president and CEO Bill Nader explained that deals involving up-front payments incentivize the player to maximize the amount they wager on the track's product.

“For example, if the player bets over a certain threshold, the player benefits from a high-volume discount. If the player does not reach that wagering threshold, the effective rate would be higher than other CAW players,” wrote Nader.

But could the deal that Del Mar struck with Elite 17 have prompted other CAW players-and Elite 2 in particular-to have curbed their play at the track last year?

The California racing source said that other CAW players were offered similar terms to Elite 17 last year. However, it should be noted that the other CAW players that wager through Elite Turf Club on Del Mar didn't bet to nearly the same volume as Elite 17 last year, and that Elite 2 was the only Elite Turf Club player to wager in the region of Elite 17's handle in 2021.

The California racing source also noted how CAW play is closely aligned with overall handle on a track's product, and that declines in total handle would invariably lead to decreases in CAW play.

“It's hard for us to say with any certainty why player A or B may have reduced his or her volume of play,” the source said. “The best source for that is the player themself.”

The TDN reached out to a representative of the player believed to be Elite 2, who declined to discuss the situation.

Here, it should be noted that at least one Elite Turf Club player increased their play between 2021 and 2023. This was Elite 10, who wagered $4.9 million in 2021 and $6.7 million in 2023 on Del Mar's product.

The TDN does not have access to data showing individual CAW handle on Del Mar's product in 2022. That was the year the California Horse Racing Board (CHRB) stopped making such data publicly available. Even so, California remains more transparent than other jurisdictions about what CAW data it makes publicly available.

Another wrinkle in this story is how Del Mar boasts an attractive wagering product with good field sizes and an impressive safety record. With that in mind, was the deal the right one to strike?

“With the benefit of hindsight, it has been the wrong deal for over 10 years and this is why we need a market correction,” wrote Nader, in response to a series of questions. “We represent the owners and purses are paid to owners, trainers, and jockeys, and there is room for improvement. This is what the TOC hired me to do.”

When asked why the TOC approved the deal last year, Nader wrote how 2023 “was my first full year with the TOC and we needed time to work with our Board members and others, notably the tracks, to voice our reservations and allow for a period of adjustment. This entire exercise has been a work in progress.”

WHY IS THIS IMPORTANT RIGHT NOW?

The issue of shrinking purse revenues amid declining economic benchmarks couldn't be a more pressing issue in California right now, where the industry attempts to piece together a revised racing framework in the wake of Golden Gate's impending closure in June.

At the end of the day, therefore, those arguably most impacted by decisions around managing CAW play are the industry stakeholders attempting to eke out a living from the sport.

When asked for comment on the story, the California Thoroughbred Trainers (CTT) wrote in a prepared statement how, “based on Del Mar's representations and the TOC's confirmation of how the purse account there has been managed, we can only say we're disturbed and confused. In January of 2021, at a CTT Board meeting, we attempted to question TOC leadership at the time about how purse levels were being funded, and were angrily rebuked by those in charge.”

At that point in time, Greg Avioli was TOC president.

“Since purses are the lifeblood of our sport, and are fueled by the public's interest and its confidence in the integrity of pari-mutuel betting, the apparent lack of transparency we're hearing about now has to be remedied immediately,” the CTT added.

According to CHRB executive director, Scott Chaney, the agency is “keenly aware of the questions, importance and interest surrounding CAWs and plans to place the topic on our meeting agenda in the next month or so.”

Chaney added how “the concepts of purse accounts and structure are also vitally important to racing in California, therefore in order promote understanding and transparency, we are in the process of amending our race meet license application to include additional questions in this area.”

All of which leads to this question: Will Elite 17 be offered the same deal this year?

“No. Negotiations are ongoing across the entire customer sector,” wrote Nader.

“High-volume players will agree that two key deliverables to make their business models more attractive are access and liquidity to commingled pools,” added Nader. “Our racetrack partners should also understand the collective upside and if everyone can take a step back and look at this thing holistically, we can work it out.”

Not a subscriber? Click here to sign up for the daily PDF or alerts.