By Chris McGrath

Here's a conundrum, given the recent contributions of Europe's premier yearling sale to a headlong rise in the global value of elite bloodstock. Because while Tattersalls Book 1 surpassed even some of last year's giddy returns, achieving fresh records in turnover and median, the fact is that prices-for its very wealthiest patrons—have actually come down three times in four years.

For while both the backgrounds and aspirations of the game's biggest spenders remain international, what appears to be a single boom in the worldwide market also reflects local factors.

The principal driver to that market, since its recovery from the banking crisis of 2008, has admittedly been a universal one: a decade of spending stimulus through quantitative easing, pointless interest rates etc. That creates a universal exposure, too, in that economies have been kept on the same drip even after recuperating, leaving the medicine cabinet bare should they fall sick again.

But this spectre has not only largely failed to arrest spending at premier sales from Saratoga to Sydney. In this era of radical political insularity, we are now also seeing fresh spurs to participation in local markets—both by accident and design.

On one side of the Atlantic, for instance, tax breaks for the most affluent have enabled them to shrug off any hesitation invited by reviving interest rates, energy prices and tariff wars. On the other, however, the impetus is less calculated. And paradoxically enough, given its roots, it is all to the advantage of wealthy foreigners.

For when polling stations closed on 23 June 2016—the day that the British, playing with matches, suddenly detonated Brexit—sterling stood at $1.50. By the time Book 1 was staged that autumn, it was down to $1.22. It has settled at both subsequent sales at more or less the same mark, around $1.32. The result, in a market dominated at the top end by overseas speculators, has been to make the stock offered at Tattersalls less expensive for its international customers now than was the case five years ago.

So while turnover at Book 1 last week was a whopping 34.3% higher than in 2014, conversion at the prevailing rate of exchange shows that the average cost of a Book 1 yearling that year was $393,893—compared with $376,564 last week.

In terms of their own Book 1 ledger, Tattersalls have been able to boast of seven consecutive record sales. That's a legitimate reflection of the quality of stock and its presentation, even if the average dipped 7 percent on last year's record. But if you were spending petrodollars, to take a not very random example, you would view things rather differently.

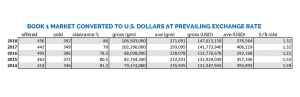

This table charts the way the market would look, either side of the referendum ripping a hole in the keel of sterling:

You'll see that in 2016 both turnover and average registered increases, albeit relatively modest ones at 6.4% and 2.5%, respectively, for Tattersalls' accountants and indigenous clients. But if you were spending sterling (or, strictly, guineas) you had converted on the currency market, it felt very different. You could have bought the whole catalogue for 15.2% less than the previous year, at an average down 18.2%.

Even a degree of recovery in sterling's value since has not prevented international spenders being able to acquire arguably the best yearling stock in Europe—at the height of a bull run in the overall market—at a historically attractive rate.

That bull run, as sustained by the post-crash cash doping noted above, remains measurable if we combine results at Book 1 with its prelude at the Goffs Orby Sale.

The Orby, another flourishing auction, has managed to grow even as the Irish industry began to absorb the potentially disastrous local consequences of Brexit. The time, for instance, it clocked transactions worth €43,497,000 at an average €132,613, up from €40,702,500 and €109,122 at a wait-and-see sale last year (which was virtually unchanged from €39,925,000 and €109,986 in 2016).

Combined with Book 1, over the equivalent period to the table above and converting guineas to euros at the prevailing rate, the gross has advanced in every year except for 2016—when you really could make hay with sterling. From 2014 to now, the combined market has grown 19% in gross and 14.4% in average.

Good enough, especially compared with the premier yearling sale in France which has essentially just held steady in the meantime. In a roaring U.S. market, however, combined turnover at Keeneland September and Fasig-Tipton's July, Saratoga Select and New York Sales has soared by 38.2% just since 2016—from $272,890,500 to $377,140,400.

How absolutely critical, then, are the few big players who contribute to both markets—none bigger, it goes without saying, than the Maktoums.

Godolphin was the top spender at the Keeneland September Sale, giving $19.96 million for 27 horses (including four for Godolphin Japan); followed by Shadwell at $12.345 million for 19. At Book 1, operating through Stroud Coleman, Sheikh Mohammed's stable likewise topped proceedings by giving 21,075,000gns on 36 lots. In fact, colleagues Emma Berry and Kelsey Riley estimated in their concluding sales report that Sheikh Mohammed, Sheikh Hamdan and their cousin Sheikh Mohammed Obaid between them accounted for just over 30% of business conducted across Book 1.

Sheikh Mohammed has topped the sale in seven of the last eight years and it has long been axiomatic that the industry has never had a more valued investor. It should consider itself blessed that he should remain so fervently engaged in the marketplace, even after his breeding empire has had so long to mature.

While demonstrably fairly immune to the bottom line, he is an obvious example of someone who will scarcely be discouraged by the weakness of the host currency. More pertinent, perhaps, is the interest he presumably derives from the sensible admission, over the last year or so, that limiting his options on account of that long froideur with Coolmore ultimately served only to magnify the odds against what is already a challenging enterprise.

If he thinks the nicest horse in the sale is by Galileo (Ire) (Sadler's Wells) it must feel quite liberating to be able to do something about it. Last week he bought four for 3,900,000gns, among several others by Coolmore sires. There was little evidence of reciprocation by the other camp, but several top-class Coolmore mares were sent to Dubawi (Ire) (Dubai Millennium {GB}) this spring and, having long been credited with far-sightedness, the Sheikh will be gratified by the knowledge that the whole industry is relieved by the rapprochement.

Interestingly, however, any presumption that a renewal of cordial contention between the superpowers might lead to extra profits may have been misplaced. Yes, it's splendid that both might be in the market for any animal. But that is only going to happen sporadically, and there is no immediate evidence that détente has brought any particular dividends in the spread of spending.

Obviously the behaviour of the Maktoum and Coolmore camps will affect the experience of other ambitious spenders, in terms of how far they are prepared to go—either to prevail for a horse or to give up on one. But if we look at the history of Book 1 since it was streamlined in 2011, and assess the market share of the top 10 spenders each year, it would be very hard to claim that a free hand for its pre-eminent force has made the slightest difference to values.

Coincidentally, as the table shows, the top 10 investors in 2011 and 2018 bought exactly the same number of horses. And while the market's overall inflation means that those 151 horses cost more than twice as much this time round, they represented a nearly equivalent share of the sale gross: 60.2% in 2011, 61.1% this year.

Sheikh Mohammed's importance to Book 1 can be judged from the one year in which the market share of the top 10 purchasers dipped significantly as a proportion of both the gross and individual transactions: 2015 also being the one year in which he was not the sale's number one spender.

Both the Sheikh and Coolmore were among those taken with the work of Newsells Park Stud, which had a stellar sale, processing 18 animals for 11,055,000gns for a knockout average 614,167 gns. An eight-figure consignment is right off the charts, so huge congratulations to Julian Dollar and his team. An incredible week for the firm, all told, having started with a second Arc success for a graduate of Nathaniel (Ire) (Galileo {Ire})'s first crop.

Quite what Nathaniel needs to do to get due market recognition remains to be seen, having moved on two of only three Book 1 offerings for €208,000. That would represent a decent yield on his fee, but a catalogue like this gives no reliable reading of the going rate. For the same reason, we'll resist the flattering snapshots being touted about sires who supposedly offer more commercial appeal, and make a broader review of stallion performance once the calendar has advanced sufficiently to sample the full spectrum.

The same caveat should be applied to the whole market, naturally, with the rest of the iceberg eroded by overproduction and the tightening of belts among breeze-up pinhookers—as already seen across the likes of Arqana V2, Fairyhouse, the Sportsman's and BBAG.

For now, taken as a whole, the top tier still seems to be bubbling away from Keeneland to Kill. Yet it was incredible to see such polar divergence, last week, in the respective graph-lines of trading at Newmarket and Wall Street. If even the longest bull run in stock exchange history is beginning to do so, we may yet have to recognise that there is no such thing as a market where the only way is up.

Not a subscriber? Click here to sign up for the daily PDF or alerts.